Sprouts Farmers Market, Inc. SFM has been on a stellar run, with its stock surging an impressive 22.1% over the past three months. This rally, driven by robust financial performance and strategic growth initiatives, has caught the attention of investors. But with such a meteoric rise, the key question arises: Should investors lock in gains, or is there still room for further growth?

Demand for food at home and increased attention to healthy living have strengthened Sprouts Farmers’ overall performance. In the said period, SFM comfortably outpaced the Zacks Food-Natural Foods Products industry’s rise of 13.6%. Sprouts Farmers’ operational capabilities have also helped it outperform the broader Retail and Wholesale sector and the S&P 500 index, which posted respective gains of 7.3% and 4.1%.

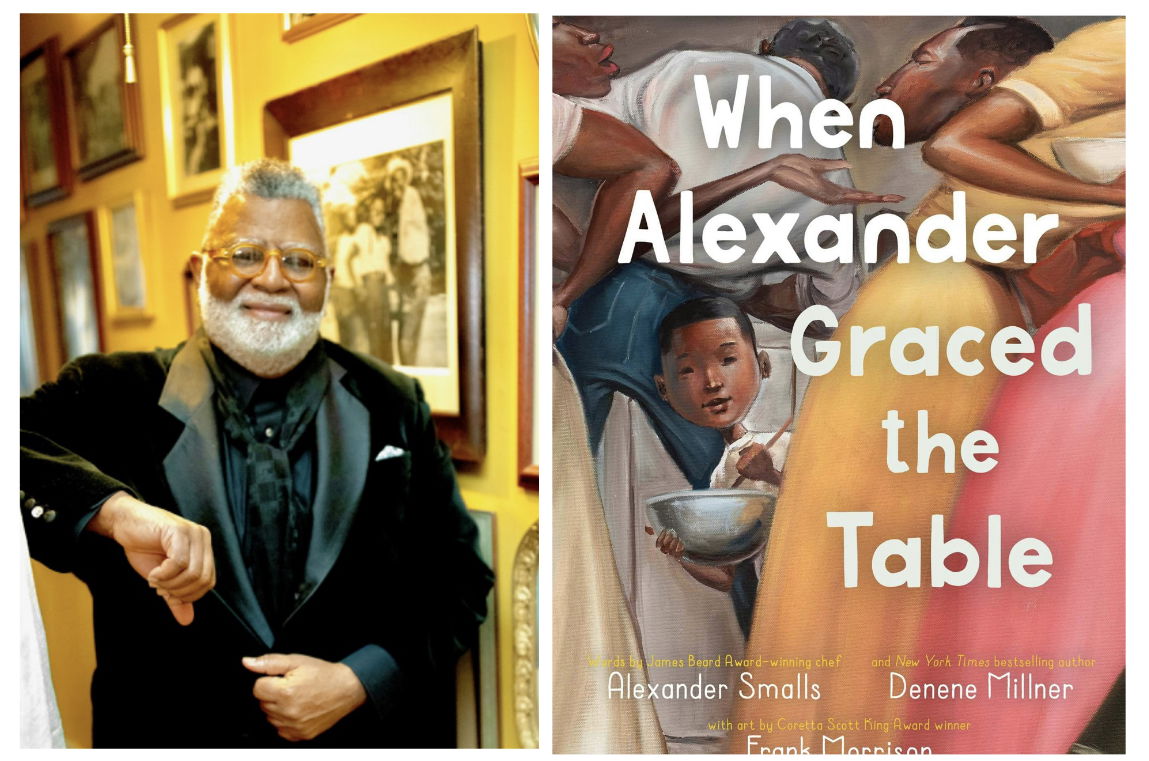

Sprouts Farmers stock closed at $138.94 yesterday, positioning it 10.7% below its 52-week high of $155.64 reached on Nov. 29.

Image Source: Zacks Investment Research

Sprouts Farmers’ commitment to offering fresh, natural and organic products aligns with the growing consumer demand for healthier food options. Organic products now account for 46% of total produce sales, growing faster than conventional offerings, while its exclusive protein programs and unique meal solutions cater to evolving consumer preferences.

The introduction of more than 300 new Sprouts-branded items in 2024 reflects the company’s ability to meet evolving customer demand. This product differentiation, combined with strong marketing efforts targeting younger demographics, is driving increased traffic and loyalty among its target customer base.

Sprouts Farmers is actively pursuing store expansion, targeting areas with high growth potential. On its last earnings call, the company highlighted its plan to open 33 new stores in fiscal 2024. Approximately 80% of its stores are located within 250 miles of a distribution center, enhancing logistical efficiency and reducing costs. The company has introduced a new store format designed to maximize selling space while minimizing construction costs.

The company’s digital and loyalty initiatives are strengthening customer engagement and retention. E-commerce sales surged 36% in the third quarter of fiscal 2024, accounting for 14.5% of total sales. The launch of a new loyalty program, currently in the test phase, is designed to personalize customer experiences and increase shopping frequency. These efforts align with the company’s long-term strategy to utilize customer data for targeted marketing and tailored promotions.

Sprouts Farmers generated $520 million in operating cash flow through the first three quarters of 2024, providing ample liquidity to self-fund growth initiatives. This included $132 million in capital expenditures (net of landlord reimbursement), primarily allocated to store expansion and infrastructure investments.