We’ve been having the wrong conversation about aging in America. Let me be clear. It’s not that we’ve completely avoided the topic. During an election that pitted with two of the oldest presidential candidates in American history against each other, and especially after President Joe Biden’s calamitous debate performance, we spent a lot of time jawing about the age and capabilities of our political leaders.

But that focus on the candidates’ elder status distracts us from a seismic issue that should really merit our attention: the historic surge in Americans who will be turning 65 over the next five years. Over the past decade, a steady cadence of 10,000 people a day were turning 65.

In 2024, that daily number jumped to more than 11,200. By the end of 2025, close to 12,000 people a day will turn 65 for the next two years, according to the U.S. census, as the U.S. enters what demographers call the “Peak 65 period,” when all those baby boomers march into their senior years.

The U.S. population is older at this moment than it has ever been, according to the Population Reference Bureau, and the number of Americans age 65 or older will increase by a whopping 47% by 2050. At that point, the tally of 82 million older adults will represent 23% of the U.S. population, according to the PRB.

We are looking at what is reportedly the largest leap in retirement eligibility that America has ever seen, and it is happening at a moment when the gaps in our retirement system are impossible to ignore.

Because all those silver-haired boomers don’t have the pensions or the savings that previous generations could count on, the massive cohort of aging Americans represents a tidal wave that will rock almost every aspect of our economy. AARP calls this demographic trend the “Silver Tsunami.” Other financial forecasters have used a different metaphor, likening the trend to a massive iceberg that the ship of state can’t maneuver around.

One in five Americans over age 50 have no retirement savings according to AARP, and 61% are worried they won’t have enough socked away to live on in their senior years. For 1 in every 3 Americans, credit card debt outpaces their emergency savings, and more than 1 in 4 people have no emergency savings at all.

And those savings may have to stretch over more years because the average life expectancy is increasing. The Centers for Disease Control and Prevention’s vital statistics surveillance report projects that a man turning 65 this year is expected to live to age 84 on average while an average 65-year-old woman is expected to live to 86. Because Americans are living longer, many of those boomers will remain in the workforce longer, but forecasters worry that those extra years on the job won’t translate into extra retirement savings.

I am going to keep an eye on this demographic trend and return to this issue in coming months because it will touch almost every aspect of our economy and American life in general.

As I talk with local government officials about the so-called Silver Tsunami, it becomes clear that cities and counties are quietly bracing themselves for an epidemic of evictions, poverty and even homelessness among the elderly, many of whom are divorced, single or living far away from relatives or a reliable support system because families now tend to be more spread out geographically.

Some states are taking a proactive approach. California, Massachusetts, Minnesota, Texas and Colorado all have multisector master plans on aging that help the state and its residents prepare for housing, health, caregiving and affordability. Nine other states are developing such master plans.

House Speaker Mike Johnson, R-La., has pledged that cuts to Medicare and Social Security will not be included in the legislative package intended to fund Trump’s agenda. With a slim majority, Johnson knows those cuts would be a nonstarter because no Democrat would be on board with slashing those programs. But even a status quo approach to elder retirement programs may not be enough to stave off disaster with such a large number of seniors with staggering needs. And in his first days in office, Trump has already signed executive orders that reverse Biden-era executive orders on health care, including the effort to limit the cost of prescription drugs for those on Medicaid or Medicare.

For a president who is so focused on projecting strength and virility, will Trump lead the discussion this nation needs to have on the Silver Tsunami? Perhaps, but probably not.

It is indeed a blessing for anyone fortunate to live well beyond six decades and also a blessing for the people in their orbits who benefit from their wisdom, their attention and their companionship. Yet when so many people are entering that chapter all at once, shouldn’t we be paying more attention to how we can enhance the gift of long life with planning and preparation?

Loved ones are often the first line of response when seniors need help with bathing, toileting, dressing or preparing meals, but as the needs grow, families may need to turn to outside help or long-term care, which a report from the Henry J. Kaiser Family Foundation found can cost $60,000 a year or more.

That same report found that fewer than half of adults had ever had a serious conversation with their loved ones about who would take care of them if they became incapacitated. This is a good time for families to create their own master plans and assess how well prepared (or not) elders are for their later years. As noted above, states are bracing for this massive wave of elderly residents. Families might also want to seriously consider the impact on their finances, housing and ability to juggle caring for someone with great needs, while also keeping up with work and other responsibilities.

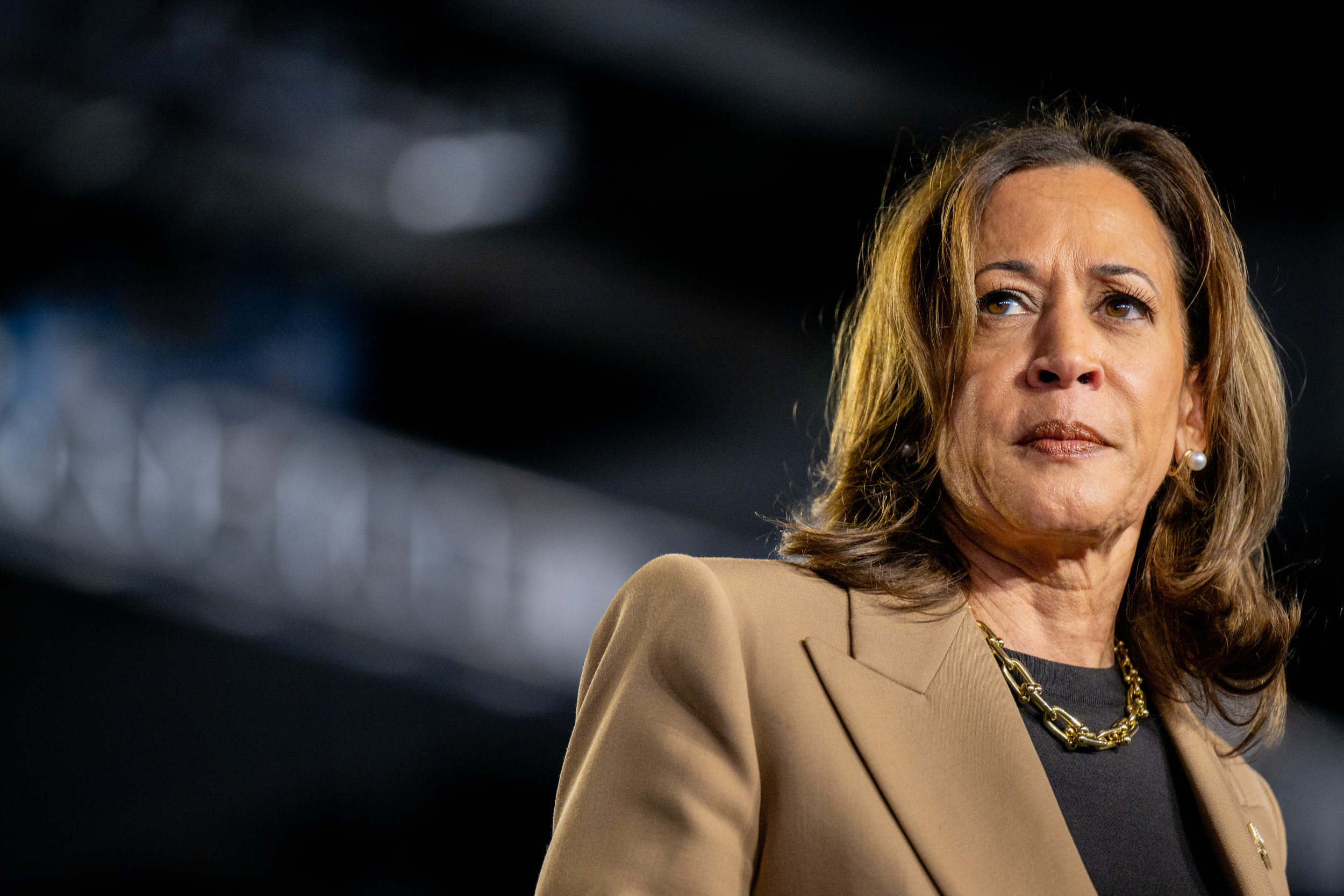

During last year’s presidential campaign, Vice President Kamala Harris laid out a proposal for expanding Medicare to cover the cost of home-based long-term care and adjusting the spend-down requirements for Medicaid that can pull some recipients and their loved ones close to poverty before they qualify for services.

It is unlikely that the Trump team would take up Harris’ specific proposal to reduce the price tag for long-term care. But because voters cited economic concerns as one of the reasons for voting for him, he would be wise to direct his administration to focus on easing the cost of aging in America. If you think the price of eggs is high, just look at the monthly cost for in-home health care or rent at a housing complex for seniors.

Overall, addressing this issue bumps up against a grim irony in politics, especially in a year where there has been a critical and you might even say withering focus on elder leaders in both parties who are thought to have stayed in their positions decades beyond the typical retirement age. That “how old is too old” political flashpoint means that some of the very officials who should be leading this discussion about the “gray wave” may be disinclined to draw attention to their own advanced age. I hope that changes, because American needs strong leadership on this issue. If not, the decision to ignore it won’t age well.

This article was originally published on MSNBC.com