CalMaine Foods, Inc. CALM announced that it has acquired all the assets of ISE America, Inc. and certain affiliates. This move will advance CalMine Foods’ market reach in the Northeast and Mid-Atlantic states.

ISE has many years of experience in the egg production industry and an excellent credibility in the marketplace.

These acquired assets from ISE consist of commercial shell egg production and processing facilities with a current capacity of roughly 4.7 million laying hens. This includes 1 million cage-free and 1.2 million pullets, feed mills, about 4,000 acres of land, inventories, and an egg product-breaking facility. The assets additionally include a vast customer distribution network across the Northeast and Mid-Atlantic states, as well as production facilities in Maryland, New Jersey, Delaware, and South Carolina.

CALM purchased the assets for around $110 million, which it funded with available cash on hand.

The increased manufacturing and distribution capabilities gained from the acquisition will enable CalMaine Foods to serve new customers and expand capacity, especially in the Northeast, which is primarily a new area for the company. CALM is also purchasing producing assets for the first time in Maryland, New Jersey, and Delaware.

CalMaine Foods reported third-quarter fiscal 2024 earnings per share of $3.00 in third-quarter fiscal 2024. The bottom line marked a 55% decline from the year-ago quarter. Sales plunged 29.5% year over year to $703 million in the third quarter of fiscal 2024.

The company had reported exceptionally strong third-quarter fiscal 2023 sales of $997 million, mainly due to record-high egg prices. Last year, the shell egg industry had witnessed record high market prices triggered by the highly pathogenic avian influenza and other market factors that had led to a significant reduction in the supply.

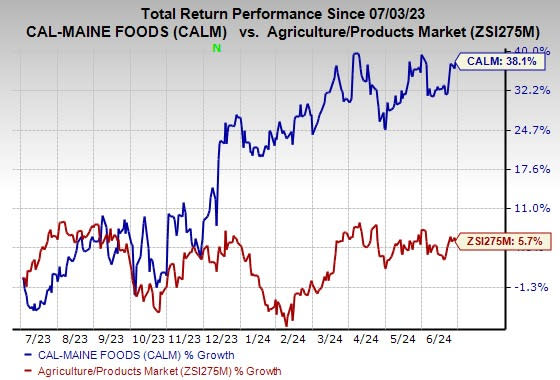

Price Performance

CALM shares have gained 38.1% in the past year compared with industry’s 5.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

CalMaine currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Ero Copper Corp. ERO , Ecolab Inc. ECL and ATI Inc. ATI. ERO sports a Zacks Rank #1 (Strong Buy) at present, and ECL and ATI have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ero Copper’s 2024 earnings is pegged at $1.66 per share. The consensus estimate for 2024 earnings has moved 20.3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 53.9%. ERO shares have gained 9.5% in a year.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.59 per share, indicating an increase of 26.5% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.3%. ECL shares have gained 34.5% in a year.

The Zacks Consensus Estimate for ATI’s 2024 earnings is pegged at $2.41 per share. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 8.3%. The company’s shares have rallied 65.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Ero Copper Corp. (ERO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research