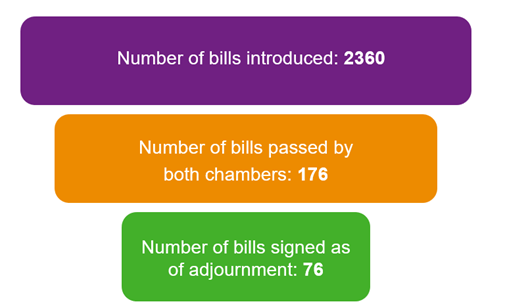

2025 Legislative Session Timeline

The first session of the 91st General Assembly of Iowa adjourned sine die just after 6 a.m. on May 15 after a full night of caucuses and debate. Slated for 110 days, the legislature extended 13 days beyond May 2 after reaching an agreement on a $9.425 billion state budget for fiscal year (FY) 2026 and much back-and-forth on major policy issues.

As the session began, the legislature was expected to address several major policy issues, including tax reform (specifically property tax reform), tax credits, energy, pharmacy benefit manager (PBM) reform, and workforce.

Factors driving the work of the 91st General Assembly included:

- The first year of a General Assembly result in a number of new bill introductions and often spills into the second year of the General Assembly.

- Lower revenue projections from both the December and March Revenue Estimating Conference (REC)

- Supermajorities in both chambers

- 53% of legislators were serving in their first or second terms

- 22 new legislators

Eminent Domain Agreement Reached

One of the most controversial topics in the Iowa legislature relates to proposed carbon capture pipelines, which would be constructed between ethanol plants in Iowa, Nebraska, South Dakota, Minnesota, and North Dakota, where carbon dioxide would be sequestered underground.

In the final weeks of session, twelve GOP Senators pledged to refuse to vote for any budget bill unless HF 639, without any amendments, was voted on. Twelve GOP Senators and the 16 Democrat Senators secured enough votes to completely block a budget vote and to delay adjournment. After four hours of intense debate on Tuesday, the Iowa Senate passed the bill as sent by the House on a split ticket vote (27-22), with one of the original twelve, Senator Rocky De Witt, flipping, and another Republican Senator, Julian Garrett, voting in favor of the bill. The bill is now on the Governor’s desk, where it awaits her signature or veto.

Tax Credit Overhaul

HSB 305 and SSB 1205 sought to overhaul the tax credit framework under the Iowa Economic Development Authority (IEDA). The proposed legislation replaced or eliminated several existing tax credit programs, including the Angel Investor Tax Credit and High-Quality Jobs Program, while introducing the Business Incentives for Growth Program and the Sustainable Aviation Fuel Production Tax Credit. The expressed goal of the bill was to modernize the tax credit system after adjustments to the overall tax landscape in Iowa in recent years.

After amendments by both the House and Senate, the proposal (now SF 657) passed both chambers on the last days of session with only four no votes total. The bill now goes to the Governor’s desk as one of the most consequential bills related to tax credits to be passed in recent Iowa history.

Property Tax Legislation Stalled

Heading into session, property taxes were consistently named as a top priority by all members of leadership in the House and Senate. In early March, Ways and Means Chairs introduced HSB 313 and SSB 1208, representing the largest overhaul of the property tax process since the 1970s. After ongoing conversations, the legislators introduced HSB 328 and SSB 1227 made significant changes to the previous Property Tax plan. On May 8, the sponsor of the Senate bill, Senator Dawson, unveiled an amendment to the plan, which was adopted in the Senate Ways and Means Committee on the same day. SF651 (formerly SSB1227) incorporated the amendment language.

Ultimately, the legislature did not advance comprehensive property tax reform this session. End-of-session conversations in the Iowa House revolved around ensuring that whatever ultimately is passed on property taxes best accomplishes the goals of simplifying Iowa’s property tax system and providing long-term property tax relief to Iowans. Comprehensive property tax reform is likely to remain a top priority during the next legislative session in 2026.

Opioid Settlement Fund

Voting on HF 1038 appropriating funds to address the opioid crisis in the state of Iowa was one of the final actions taken in the late hours of the evening by the Iowa legislature. The funds come from large intra-state settlements with the corporations involved in the production and sale of opioids. The settlements, in 2021 and 2022, provided Iowa with $56 million to spend on opioid prevention and enforcement. However, until this year, the Iowa Legislature had not appropriated the settlement funds towards those goals.

The bill authorizes a $9.1 million standing appropriation to Administrative Services Organizations and $3.9 million for statewide prevention initiatives in FY 2026, FY 2027, and FY 2028. For FY 2026, the bill deposits $20 million into the Opioid Reserve Account, which will then be used to fund initiatives in the future. HF 1038, when signed by Governor Reynolds, will provide substantial funding opportunities to prevent and treat opioid addiction.

Governor Reynolds’ Legislative Priorities

In the first week of session, Governor Kim Reynolds laid out her agenda in her Condition of the State Address. The speech covered a wide range of policy priorities, including reforming math education, banning cell phones in schools, addressing increased cancer rates in the state, and establishing a state-level Department of Government Efficiency (DOGE).

- Rebuild Our Communities

- Student-Focused Education from PreK-12

- Building a Strong, Competitive Iowa

- Building on an Affordable, Reliable, and Sustainable Energy System

- Ensuring Excellent Healthcare for All Iowans

- Saving Iowans Money

- A Solid Foundation for Iowa Families

To support her priorities, the Governor introduced 10 bills related to math and civics standards, rural healthcare worker shortage, disaster recovery housing assistance, electronic devices in school, teacher salaries, contribution rates for unemployment benefits, paid parental leave for school employees, early education and care, and energy.

Following adjournment, Governor Reynolds released a statement applauding the work done by the legislature to advance these priorities, stating:

“I’m proud of the work we did this session to expand on the strong foundation we’ve built over the last several years in healthcare, education, and tax reform…. I look forward to continuing this work next session—especially when it comes to reducing Iowans’ property tax burden. And to make sure tax cuts remain sustainable, even as we continue to make smart investments, we’ll keep streamlining government. Our alignment efforts, so far, have already saved taxpayers more than $250 million, and we’re just getting started.”

What’s next?

Dentons Davis Brown Government Relations clients will receive a comprehensive review of all legislation of interest from this legislative session once the Governor’s 30-day veto period is over.

Now that the legislature has adjourned, elected officials will turn their attention to interim activities, including fundraising, in-district work, and planning for the next session. Many key Iowa politicians will likely spend time exploring runs for other offices, including for governor, after Governor Reynolds announced her intention not to seek re-election in 2026.