Sysco Corporation SYY, a leader in the foodservice distribution industry, has been gaining on its strong operational strategies. Despite some headwinds, such as declining restaurant traffic and inflationary pressures, the company continues to thrive in the rapidly expanding food-away-from-home sector. Through a series of strategic efficiency measures and acquisitions, the company is positioning itself for growth.

Sysco is focused on enhancing efficiency through supply-chain productivity and structural cost-containment efforts. The company made significant strides in enhancing its supply chain productivity, which is vital for maintaining competitive service levels in the foodservice industry. Sysco rolled out a new sales compensation model on July 1, 2024, incentivizing performance and increasing new customer acquisitions. The planned exit from the Mexico JV aligns with SYY’s return-on-invested-capital framework and enables the company to reallocate resources to higher-margin, high-growth markets. This strategic divestment underscores its focus on optimizing its portfolio for sustainable profitability and global competitive advantage.

Sysco’s commitment to expanding throughput capacity, including the recent opening of a new distribution center in Allentown, PA, positions it well for efficiency in its operations. In the first quarter of fiscal 2025, the company successfully reduced corporate expenses by 14.5% on an adjusted basis, driven by efficiency initiatives implemented in fiscal 2024 and additional actions taken during the quarter.

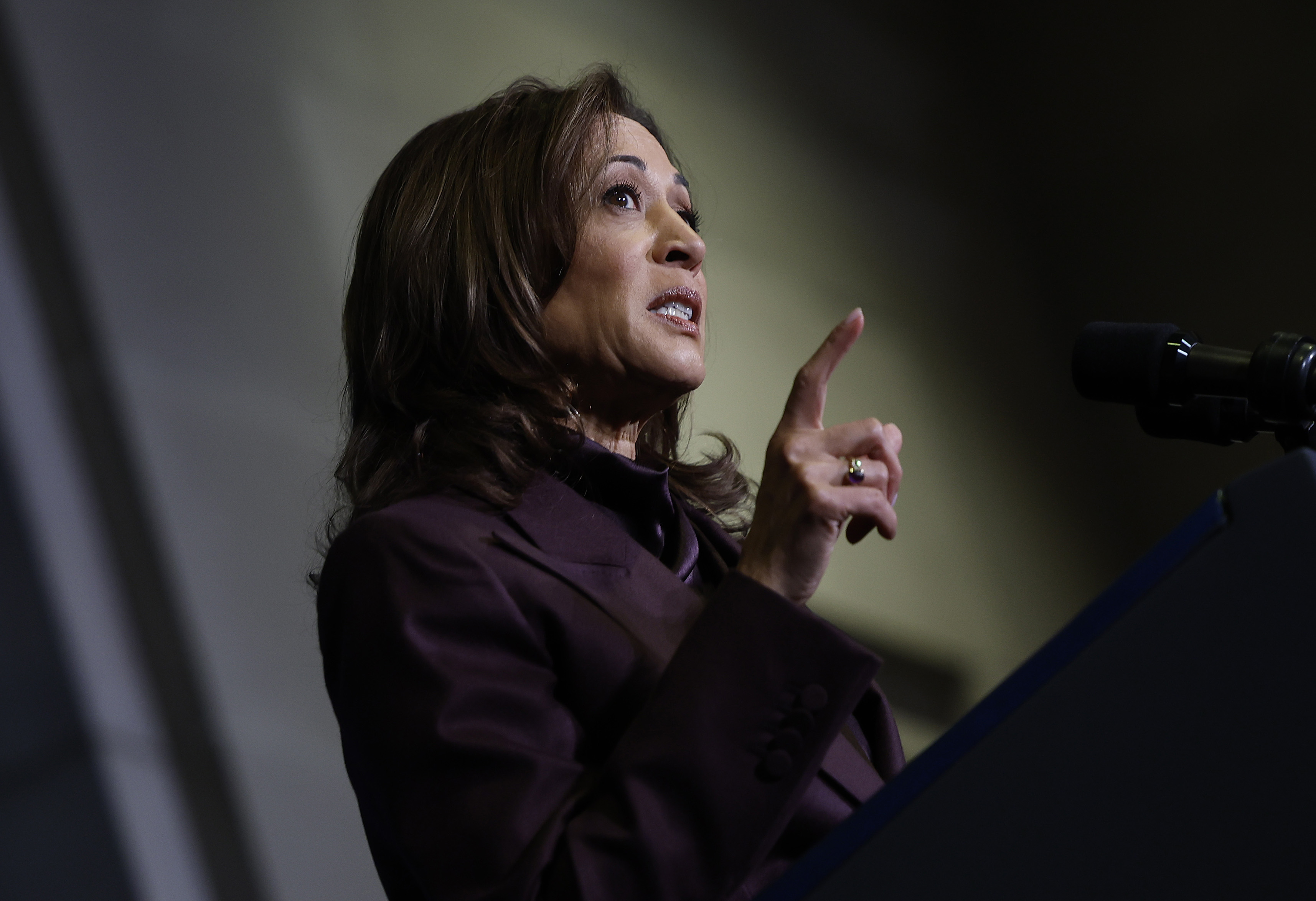

Image Source: Zacks Investment Research

The company is witnessing a notable upswing in its Food-Away-From-Home channel despite broader market challenges. In the fiscal first quarter, Sysco reported a 4.6% sales increase in the U.S. Foodservice operations. Local case volumes within the U.S. Foodservice grew 0.2%, while total case volumes within the same segment increased 2.7%. In the International Foodservice operations segment, sales rose 3%. By prioritizing innovation and tailored solutions for its diverse customer base, Sysco is well-positioned to capitalize on the evolving trends in the Food-Away-From-Home market, ultimately driving long-term growth and profitability.

Another critical factor driving Sysco’s growth is its strategic acquisition strategy. Over the past few years, Sysco has made several key acquisitions to expand its distribution network and product offerings. The company recently acquired Campbells Prime Meat, a leading specialty meat business in the U.K. Sysco acquired Edward Don & Company in early fiscal 2024, which is generating positive synergies. In first-quarter fiscal 2025, DON made a positive impact on the U.S. Foodservice volume, driving a 2.6% increase and boosting local volumes by 1.6%.

In the first quarter of fiscal 2024, Sysco completed the acquisition of BIX Produce, strengthening its specialty produce division, FreshPoint. This strategic buyout helps Sysco expand its geographical footprint into new regions and diversify its specialty produce offerings. These acquisitions align with Sysco’s “Recipe for Growth” strategy, which focuses on enhancing sales, improving supply chain efficiency, and expanding into new markets.