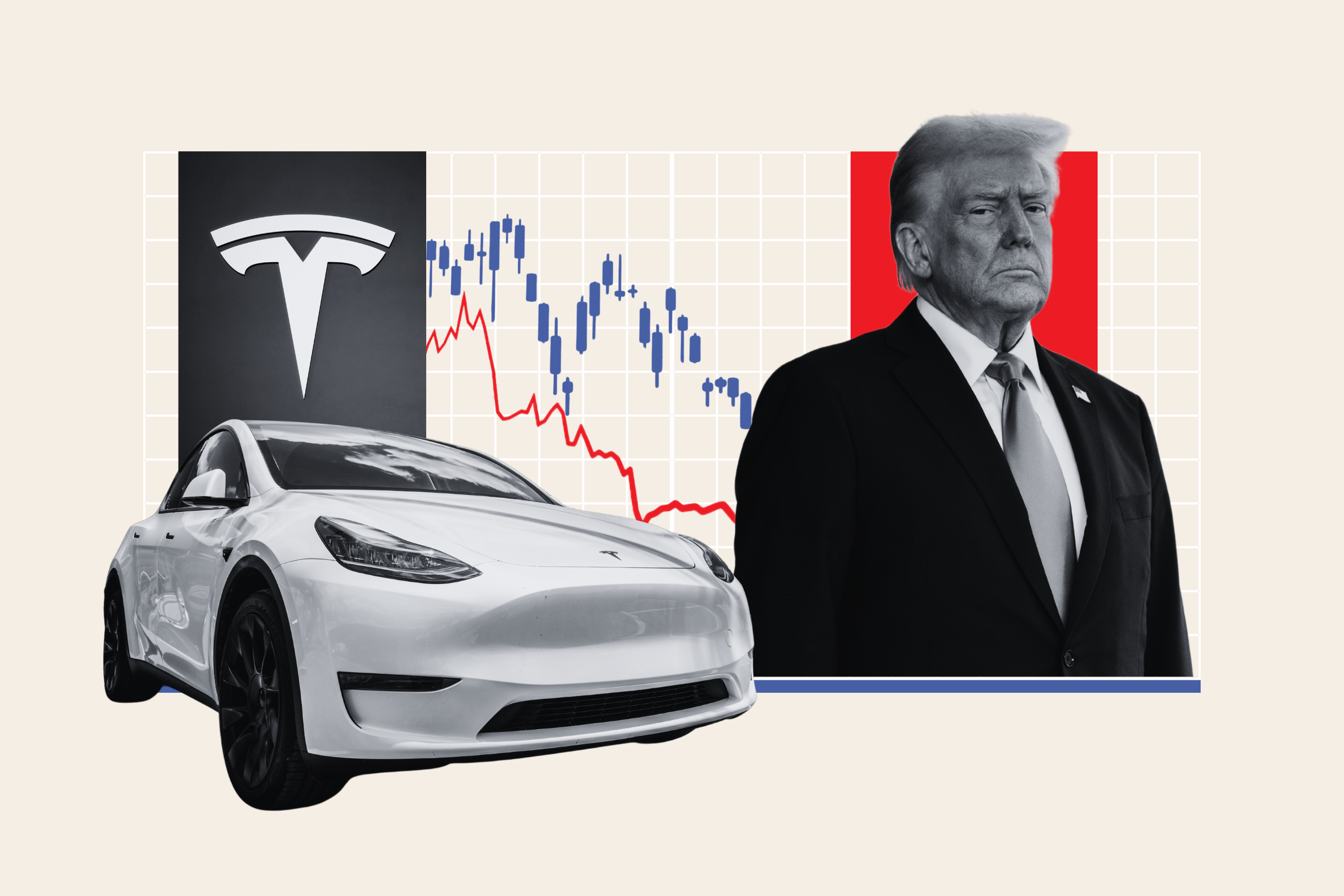

Tesla stock has been on a slide since Donald Trump was sworn in last month, with a myriad of reasons potentially to blame for the dominant company’s recent downturn.

The stock made a historic run following Trump’s victory in the 2024 presidential election, rising 92 percent to reach an all-time high of $483.99 on December 17. Tesla inched down over the subsequent weeks, closing at $426.50 on the last day of trading before the inauguration. Since Trump took office, however, its price has seen a more marked decline, shedding 20 percent to close at $336.51 on Wednesday.

Newsweek has contacted Tesla via email for comment and will update this article if a response is received.

Why It Matters

Tesla is one of the world’s most widely held stocks, its dominant performance over the past few years securing a place in the so-called “Magnificent Seven” group of companies, alongside Alphabet, Amazon, Apple, Meta, Microsoft and Nvidia. As a result, Tesla’s share price has an outsized impact on the overall success of the S&P 500.

The net worth of its CEO and largest shareholder, Elon Musk, is also intimately tied to Tesla’s stock performance, and the recent decline has contributed to a notable reduction of his overall fortune.

Why Is Tesla Stock Falling?

Tesla is the worst performing of the Magnificent Seven over the past month, in spite of Nvidia’s historic decline following the DeepSeek sell-off frenzy in late January, and data shows that Tesla’s recent sales performance, particularly overseas, has left a lot to be desired.

Photo-illustration by Newsweek/Getty

Germany’s Kraftfahrt-Bundesamt vehicle authority reported last week that Tesla sales dropped nearly 60 percent in January year-on-year, while sales in France sank 63 percent over the same period.

The U.K. saw a less drastic decline of 12 percent, despite electric vehicle sales hitting a record high in January.

This trend continued across Europe, with Tesla registrations slumping over 40 percent in the Netherlands, Sweden, Denmark, and Norway, according to electric vehicle-focused outlet Electrek, with Spain seeing the steepest decline of 75 percent.

Australia’s Electric Vehicle Council reported that Tesla’s overall sales fell 33 percent year-on-year in January, while in China, Tesla’s second-largest market behind the U.S., sales were down 11 percent over the same period, and down 33 percent from December, according to the China Passenger Car Association.

Tesla’s fourth-quarter results, released in late January, came in below analysts’ estimates. While overall revenue saw a slight increase, operating income dropped 23 percent year-over-year to $1.6 billion. Additionally, Tesla’s 1.8 million deliveries for the year marked the first annual decline in the company’s history.

The Trump Effect?

Beyond Tesla’s own performance, some have suggested that the stock’s decline may be tied to the trade policies of the new Trump administration, despite earlier predictions that his victory could usher in sweeping regulatory changes that would benefit the electric vehicle giant.

Justin Sullivan/Getty Images

On Monday, the president signed two executive orders placing a blanket, 25 percent tariff on all steel and aluminum imports to the U.S. Both metals are critical for manufacturing the body and chassis of Tesla’s vehicles.

While the president’s tariffs on Canada and Mexico have been put on a brief hold, his duties on Chinese imports have come into effect, potentially raising concerns among investors about their impact on Tesla’s operations. A 2023 study by Nikkei Asia found that nearly 40 percent of the suppliers for materials used in Tesla’s EV batteries are Chinese companies.

The Musk Effect?

Musk has emerged as a key player in the new administration, heading up the newly created Department of Government Efficiency (DOGE) while also offering firm rhetorical backing to Trump’s broader agenda.

Investors may be viewing DOGE, as well as Musk’s other activities unrelated to car manufacturing, as a potential distraction risk. Considering the close link between the CEO and the brand itself, this also promises to discourage potential customers from making Tesla their car of choice, which holds particularly true for Democrats, who a 2023 Gallup poll found were several times more likely to purchase an electric vehicle than their Republican counterparts.

His forays into European politics—throwing support behind far-right parties in Germany and the U.K.—could have a similar effect, with many making the link between this and the company’s muted European sales. According to a recent survey of 1,000 respondents by Electrifying.com, over half (59 percent) of car buyers in the U.K. had been turned off from buying a Tesla because of Musk’s actions.

What People Are Saying

“Tesla has played a pivotal role in accelerating the adoption of electric vehicles, but our findings show that Elon Musk’s personal involvement in Tesla’s brand appears to be polarising, pushing many buyers to look elsewhere,” said Ginny Buckley, Chief Executive of Electrifying.com, as quoted by This Is Money.

Andrew Harnik/Getty Images

In a note cited by MarketWatch, Stifel analyst Stephen Gengaro said: “With the Department of Government Efficiency making headlines recently regarding its efforts to streamline government agencies, options of CEO Elon Musk have taken a turn for the worse along political affiliations.” Gengaro added that negative perceptions of Musk had “potentially result[ed] in a headwind to sales.”

“Tesla’s problems are likely not to do with British motorists’ perceptions of Elon Musk,” NewAutoMotive chief executive Ben Nelmes told market intelligence outlet Argus Media, “and more to do with the fact that Tesla hasn’t released a new car since the Model Y, while its competitors have been playing catch-up.”

“While there are silver linings around some elevated China tariffs, for Tesla the worry is that Beijing retaliatory policies would then set off a trade war and create geopolitical headwinds for Tesla within this key China market,” said analysts at Wedbush Securities, in a note shared with Newsweek.

“To this point, China is a key market for Tesla and we anticipate some carve-outs for both Tesla and Apple on the China tariff front and also expect Musk to have a very big role (expanding by the day) in a Trump White House and be heavily involved in the China tariff discussions in 2025,” they added.

What Happens Next?

While the stock is down over the past month, it rose 2.4 percent on Tuesday and has risen over 70 percent in the past six months, prompting questions over how long the current downturn will last.

However, beyond Trump’s tariffs and Musk’s ongoing involvement in the new administration, the carmaker has more headwinds on the horizon, including foreign competition that threatens its status as the world leader in electric vehicles.

On Monday, Chinese electric vehicle maker BYD introduced an advanced self-driving system that it intends to equip across its entire model range, with the help of AI firm DeepSeek, hinting that Tesla’s rivals may be gaining an edge in the race toward autonomous driving.

Do you have a story we should be covering? Do you have any questions about this article? Contact [email protected].